Why South Carolina?

The best value to create the life you've been planningTaxes & Cost of Living:

Property Taxes

Property taxes in South Carolina are some of the lowest in the country. SC offers a Homestead exemption on the first $50,000 of value on your legal residence for those 65 or older.

Real Estate Taxes for a resident with a Homestead Credit on a $250,000 assessed home is a VERY LOW $1,477 or just 0.59%.

Transportation

SC’s gasoline tax is 16 cents per gallon, one of the lowest in the nation. Sales tax capped at $300 for in-state motor vehicle purchases and $150 for cars coming from out-of-state. Vehicles are taxed at 6% annually.

$15 auto-title fee and $20-24 registration every 2 years.

Sales tax

With a 6% sales tax, South Carolina ranks as one of the best in the country for most tax-friendly local taxes.

Income tax

SC has 6 income brackets ranging from 0% to 7%.

Social security income & benefits are NOT taxed.

Retired military 65 and older receive tax exemptions on the first $30,000 of military retirement pay, and those under 65 are exempted on the first $17,500. There is no inheritance tax.

Unique to SC is a 44% exclusion or subtraction from capital gains, reducing state tax on capital gains from 7% to 3.92%.

Our Top 10 Reasons to Move to South Carolina:

RELAXATION: Slower pace of life

RELAXATION: Slower pace of life

SUNSHINE: 7-8 months of warm weather

SUNSHINE: 7-8 months of warm weather

AFFORDABILITY: More bang for your buck

AFFORDABILITY: More bang for your buck

FRIENDLY: Southern hospitality at its finest

FRIENDLY: Southern hospitality at its finest

NATURE: Natural beauty in our abundance of parks, lakes, & waterways

NATURE: Natural beauty in our abundance of parks, lakes, & waterways

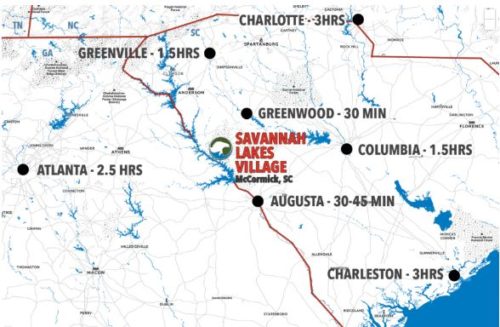

LOCATION: Ideal proximity to beaches, mountains, and metropolitan cities

LOCATION: Ideal proximity to beaches, mountains, and metropolitan cities

CUISINE: Low-country boils, barbecue, and farm-to-table southern fare

HISTORY GALORE: Architecture, landmarks, battlegrounds, museums

HISTORY GALORE: Architecture, landmarks, battlegrounds, museums

ARTS & CULTURE: Concerts and music festivals, exhibitions, galleries

FUN: College football rivalries, horse racing, and Darlington Raceway